A Comprehensive Guide to Startup Investment

Investing in a startup can be both thrilling and challenging. With the potential for high returns, it’s a rewarding venture for both investors and entrepreneurs. However, the process of startup investment requires knowledge, strategy, and a thorough understanding of the risks involved. In this guide, we will explore everything you need to know about startup investment, from the different stages to tips for finding the right opportunities and minimizing risks.

What is Startup Investment?

Startup investment refers to providing capital to new or emerging businesses with high growth potential. This capital is typically used to help startups scale their operations, enhance their products, or penetrate new markets. Unlike traditional investments, startup investments involve a higher degree of risk due to the uncertain nature of early-stage companies.

These investments can take various forms, such as equity investments, where you receive ownership in the company, or debt investments, where the startup borrows funds to repay with interest. Understanding the types of investment and what each offers is crucial before diving into the process.

Stages of Startup Investment

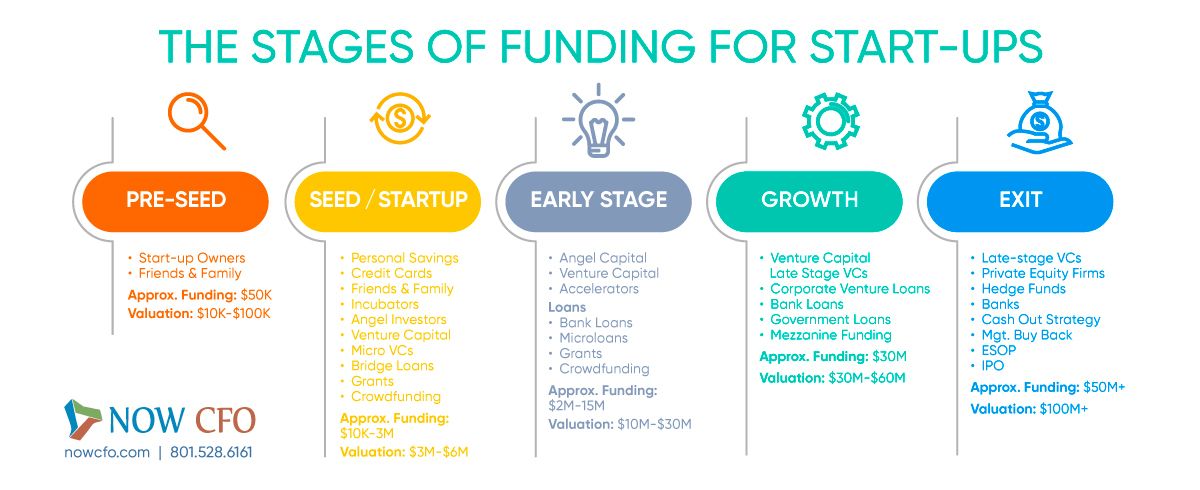

Startup investment typically progresses through several key stages. Each stage presents unique opportunities and risks, and understanding these stages will help investors make informed decisions.

1. Seed Stage Investment

The seed stage is the earliest phase of a startup. At this stage, the business is in its infancy, and the product or service is still in development. Seed investments are often smaller amounts of money provided by angel investors, venture capitalists, or sometimes, family and friends.

Key Features:

-

The startup is usually pre-revenue or in the development phase.

-

High-risk, as many startups at this stage do not survive.

-

Investment amounts can vary, but they are often less than $1 million.

While it’s riskier, seed stage investing can provide the highest potential return on investment if the startup succeeds.

2. Series A Funding

Once a startup has a proven business model and some initial traction, it enters the Series A funding round. At this point, the business is seeking funds to scale its operations, expand its market, or develop its product further.

Key Features:

-

The startup has established a customer base and generates some revenue.

-

The investment is used to expand operations, hire talent, and market the product.

-

The funding is typically larger than seed funding, often ranging from $2 million to $15 million.

Investing at the Series A stage is less risky than seed stage investing, as the company has some proof of concept and initial success.

3. Series B and Beyond

Series B and subsequent funding rounds occur when a startup is looking to scale quickly. By this stage, the startup has a proven product, a growing customer base, and a business model that works. Investors at this stage are looking for more substantial returns as the business prepares for expansion.

Key Features:

-

Significant revenue growth and market share expansion.

-

Investment amounts can range from $10 million to $50 million.

-

Often involves venture capital firms and private equity investors.

Investing in Series B and beyond can be less risky, as the startup has demonstrated success, but there’s still room for rapid growth.

How to Identify the Right Startup to Invest In

Choosing the right startup to invest in is crucial for maximizing returns and minimizing risk. Here are some key factors to consider when evaluating startup investment opportunities:

1. Market Potential

The size and growth rate of the market the startup operates in are critical factors to assess. A startup in a rapidly growing industry or market with significant unmet needs has greater potential for success. Emerging industries like artificial intelligence, fintech, and renewable energy are currently some of the most attractive sectors for investment.

2. Founding Team

A strong, experienced, and capable founding team is one of the most important indicators of a startup’s potential. Look for founders who have expertise in the industry, a track record of previous successes, and the ability to execute the business plan.

3. Product and Innovation

Investing in a startup means backing their product or service. Evaluate whether the product addresses a real problem in the market and has a clear value proposition. Additionally, consider whether the startup has a competitive edge, such as unique technology, intellectual property, or a sustainable business model.

4. Financial Health and Projections

While many early-stage startups may not be profitable yet, it’s essential to assess their financial projections and health. Review the startup’s revenue growth, burn rate (the rate at which they are spending money), and funding history to gauge whether they can sustain and grow with additional funding.

Risks Involved in Startup Investments

While the rewards can be substantial, startup investments come with inherent risks. Here are some of the main risks to keep in mind:

1. High Failure Rate

Statistics show that 90% of startups fail within the first five years. Even though a startup may seem promising, there is a real possibility that it may not succeed due to factors such as market competition, cash flow problems, or mismanagement.

2. Illiquidity

Investing in a startup means your capital is typically tied up for a long time. Unlike publicly traded companies, startup investments don’t have an easy exit option, and selling your equity stake may not be possible until the company is acquired or goes public.

3. Valuation Challenges

Determining the fair value of a startup is often subjective. The early-stage companies may not have substantial revenue or financial history, making it difficult to assess whether the business is overvalued or undervalued.

How to Minimize Risk in Startup Investment

While startup investments are inherently risky, there are steps you can take to mitigate those risks. Here are some strategies to consider:

1. Diversification

One of the best ways to reduce risk is by diversifying your investments across several startups. By spreading your investments across different industries, stages of growth, and geographic regions, you can reduce the impact of one failed investment.

2. Due Diligence

Conduct thorough due diligence before committing to an investment. This includes researching the startup’s business model, financials, competitors, and market trends. Always ensure that the founders have a clear vision and a detailed roadmap for the company’s future.

3. Stay Involved

As an investor, staying involved in the startup’s growth can help mitigate risks. Many investors take on advisory roles or provide mentorship to help guide the company. Being engaged allows you to provide valuable insights and avoid potential pitfalls.

Startup Investment FAQs

Q1: How do I find startups to invest in?

There are several platforms where investors can find startup investment opportunities, including AngelList, SeedInvest, and Crunchbase. Networking events, pitch competitions, and venture capital firms are also great ways to discover startups.

Q2: What is the minimum amount needed to invest in a startup?

The minimum investment amount can vary depending on the stage of the startup and the funding round. Seed-stage investments may require as little as $10,000, while Series A or B funding rounds could require $1 million or more.

Q3: What are the benefits of investing in a startup?

Investing in a startup offers the potential for high returns, the ability to diversify your portfolio, and the satisfaction of supporting innovation and new business ideas. If the startup succeeds, early investors can see a significant return on their investment.

Q4: What should I look for when evaluating a startup?

Key factors include the founding team, the market potential, the product’s uniqueness, and the startup’s financial health. Conducting thorough due diligence is crucial in identifying high-potential startups.

Conclusion: Is Startup Investment Right for You?

Startup investment offers incredible potential for high returns, but it’s not without its risks. By carefully evaluating opportunities, understanding the different funding stages, and minimizing risks, you can position yourself for success. Whether you’re a seasoned investor or a beginner, the startup ecosystem offers numerous opportunities for those willing to take calculated risks and support innovation.

By focusing on diversification, due diligence, and staying engaged with your investments, you can navigate the startup investment landscape with greater confidence. Start small, and as you gain experience, you can scale up your investments and capitalize on the exciting growth of emerging companies.