Entrepreneur Financial Literacy: A Key to Sustainable Business Growth

Financial literacy is a vital skill for any entrepreneur. The ability to understand and manage finances effectively can be the difference between business success and failure. Entrepreneurs who master financial literacy are better equipped to make informed decisions, allocate resources efficiently, and navigate economic challenges. In this article, we’ll explore why financial literacy is essential for entrepreneurs and provide practical insights into how you can improve your financial knowledge.

Why Financial Literacy Matters for Entrepreneurs

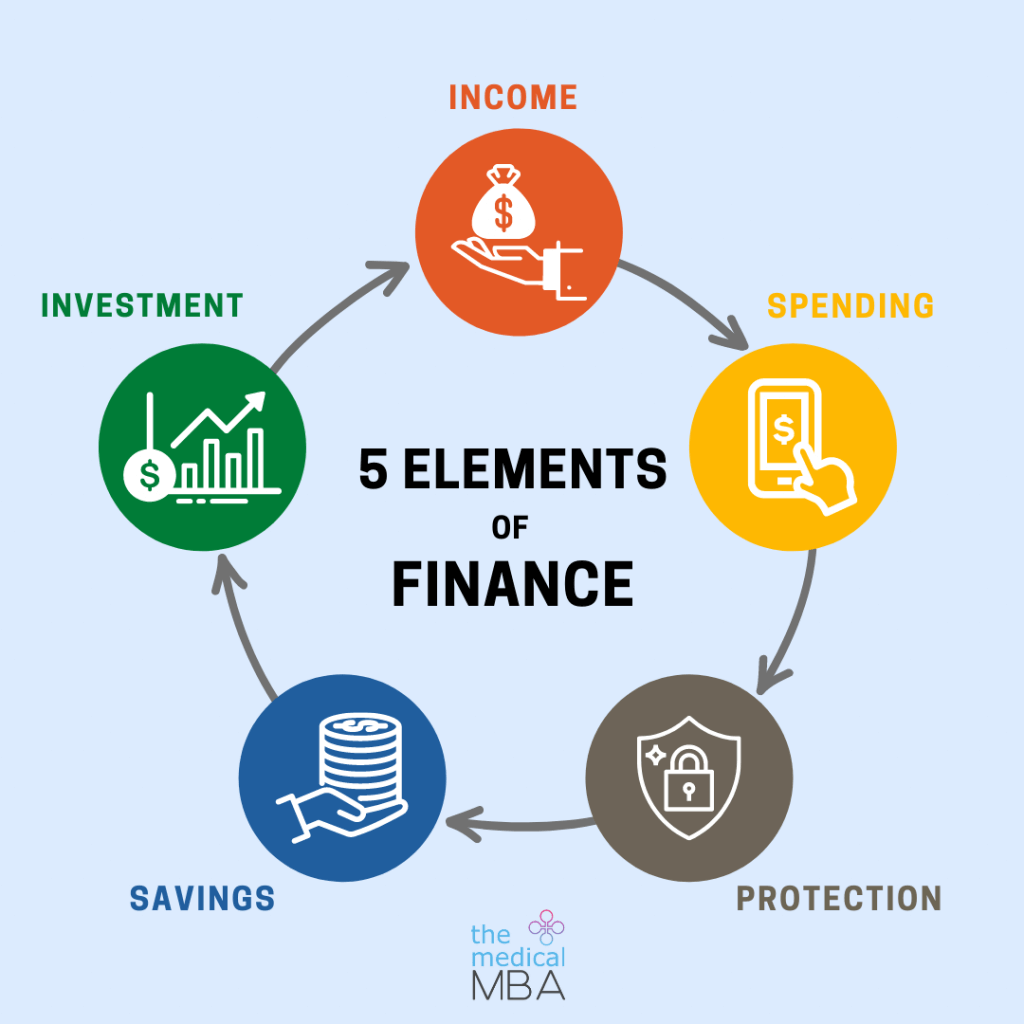

Being financially literate means understanding key financial concepts like budgeting, financial statements, taxes, investments, and cash flow management. For entrepreneurs, this knowledge is indispensable because it helps them make strategic decisions that can significantly impact their business’s bottom line.

1. Improves Business Decision-Making

Having a strong grasp of financial concepts allows entrepreneurs to make informed decisions about pricing, investments, and cost management. For example, understanding cash flow helps determine whether it’s the right time to expand or if cutting back is necessary. Without this knowledge, entrepreneurs may make costly mistakes that could jeopardize the future of their businesses.

2. Prevents Financial Mismanagement

Mismanaging business finances can lead to a cascade of problems, including increased debt and even bankruptcy. Entrepreneurs who are financially literate can avoid these pitfalls by creating accurate financial projections, monitoring their cash flow, and ensuring they have enough liquidity to handle day-to-day operations.

3. Attracts Investors and Lenders

Investors and lenders are more likely to trust an entrepreneur who demonstrates a solid understanding of financial principles. A well-prepared entrepreneur can present a clear and realistic business plan with detailed financial forecasts, which increases the likelihood of securing funding.

Key Areas of Financial Literacy for Entrepreneurs

Financial literacy is a broad field, and as an entrepreneur, you need to understand several key areas to keep your business on track. Let’s explore some of the most important financial concepts every entrepreneur should know.

1. Understanding Financial Statements

Financial statements are the backbone of any business. Entrepreneurs need to understand the three main types:

-

Income Statement: Shows the business’s revenue, expenses, and profits over a specific period. It helps entrepreneurs track profitability.

-

Balance Sheet: Provides a snapshot of the business’s assets, liabilities, and equity at a specific point in time. It’s essential for understanding the company’s financial health.

-

Cash Flow Statement: Tracks the flow of cash in and out of the business. Entrepreneurs must ensure their business has enough cash flow to operate smoothly.

By regularly reviewing these statements, entrepreneurs can make data-driven decisions that improve business performance.

2. Budgeting and Forecasting

A solid budgeting and forecasting strategy is crucial for managing a business’s finances. Entrepreneurs must create realistic budgets that account for all operational costs, including fixed and variable expenses. Additionally, financial forecasting helps predict future revenue and expenses, allowing business owners to plan ahead.

-

Tips for budgeting:

-

Track all sources of income and expenditures.

-

Include a buffer for unexpected expenses.

-

Regularly update your budget as your business evolves.

-

3. Cash Flow Management

Cash flow management is one of the most critical aspects of entrepreneurship. Without proper cash flow, your business can quickly run into trouble, even if it’s profitable on paper. Entrepreneurs should be able to project their cash flow needs to ensure they always have enough liquidity for daily operations.

-

Improving cash flow:

-

Accelerate receivables by offering discounts for early payments.

-

Negotiate longer payment terms with suppliers.

-

Keep a reserve fund for emergencies.

-

4. Tax Planning

Understanding tax laws and how they affect your business is vital for financial success. Entrepreneurs need to be aware of their tax obligations, including income taxes, sales taxes, payroll taxes, and other business-related taxes. Proper tax planning can help reduce liabilities and prevent penalties.

-

Tax-saving strategies:

-

Deduct legitimate business expenses.

-

Consider setting up a retirement plan for tax advantages.

-

Consult a tax professional to optimize your tax strategy.

-

5. Investment Knowledge

For entrepreneurs, understanding investments is important not just for growing personal wealth but also for business expansion. Whether investing in equipment, real estate, or stocks, knowing where to allocate capital is essential. Entrepreneurs must also consider the potential return on investment (ROI) for any business investment.

-

Investment strategies for startups:

-

Invest in assets that will generate income over time.

-

Diversify your investments to reduce risk.

-

Ensure that investments align with your business’s long-term goals.

-

6. Debt Management

Many startups rely on loans to finance their operations. Understanding how to manage business debt is crucial for maintaining financial health. Entrepreneurs need to know the difference between good debt (which can help grow the business) and bad debt (which can strain resources).

-

Tips for managing debt:

-

Prioritize paying off high-interest debts first.

-

Avoid taking on too much debt early on.

-

Consider alternative financing options, such as venture capital or crowdfunding.

-

How to Improve Your Financial Literacy

Improving financial literacy doesn’t have to be overwhelming. Here are a few steps entrepreneurs can take to build their financial knowledge:

1. Take Online Courses

There are numerous online courses available to help entrepreneurs improve their financial literacy. Platforms like Coursera, Udemy, and LinkedIn Learning offer comprehensive courses on topics like financial management, accounting, and budgeting.

-

Recommended courses:

-

Financial Literacy for Entrepreneurs (Udemy)

-

Introduction to Financial Accounting (Coursera)

-

Business Finance Essentials (LinkedIn Learning)

-

2. Read Books and Articles

Reading books and articles on finance is an excellent way to deepen your understanding. Many business experts have written books on financial literacy, offering practical tips and strategies.

-

Recommended books:

-

“Rich Dad Poor Dad” by Robert Kiyosaki

-

“The Richest Man in Babylon” by George S. Clason

-

“The Lean Startup” by Eric Ries

-

3. Consult with Financial Advisors

If you’re feeling overwhelmed or need personalized advice, working with a financial advisor can provide valuable insights. Advisors can help you create a financial plan, improve your budgeting skills, and navigate complex financial decisions.

-

Look for advisors who specialize in small business finances.

-

Consider using an accountant to manage your taxes.

Common Financial Mistakes Entrepreneurs Make

Even the most successful entrepreneurs can make financial mistakes. Here are some common errors to avoid:

1. Neglecting Cash Flow

Many entrepreneurs focus on growing revenue without paying enough attention to cash flow. Without proper cash flow management, businesses can run into trouble even if they’re profitable.

2. Ignoring Taxes

Tax penalties can seriously impact your business. Failing to set aside enough money for taxes or not planning ahead can lead to fines or legal issues.

3. Overestimating Revenue

It’s easy to become optimistic about your startup’s future earnings, but overestimating revenue can lead to overspending. Be conservative with revenue projections to avoid financial strain.

FAQs About Entrepreneur Financial Literacy

Q1: What is the most important financial skill for an entrepreneur?

The most important skill is cash flow management. Without sufficient cash flow, even profitable businesses can fail. Entrepreneurs need to ensure they can pay expenses and invest in growth opportunities.

Q2: How can I improve my financial literacy?

You can improve your financial literacy by taking courses, reading books, and working with financial advisors. Regularly reviewing your financial statements and learning from your business’s financial history is also important.

Q3: Should I hire a financial advisor for my startup?

Yes, hiring a financial advisor can help you navigate complex financial decisions and ensure your business stays on track. Advisors can provide valuable insights into budgeting, investments, and tax planning.

Conclusion

In today’s competitive business environment, entrepreneur financial literacy is more than just a nice-to-have skill; it’s essential for success. By understanding key financial concepts such as budgeting, financial statements, and cash flow management, you can make more informed decisions and set your business up for long-term growth. Invest in your financial education today to ensure a prosperous future for your startup.